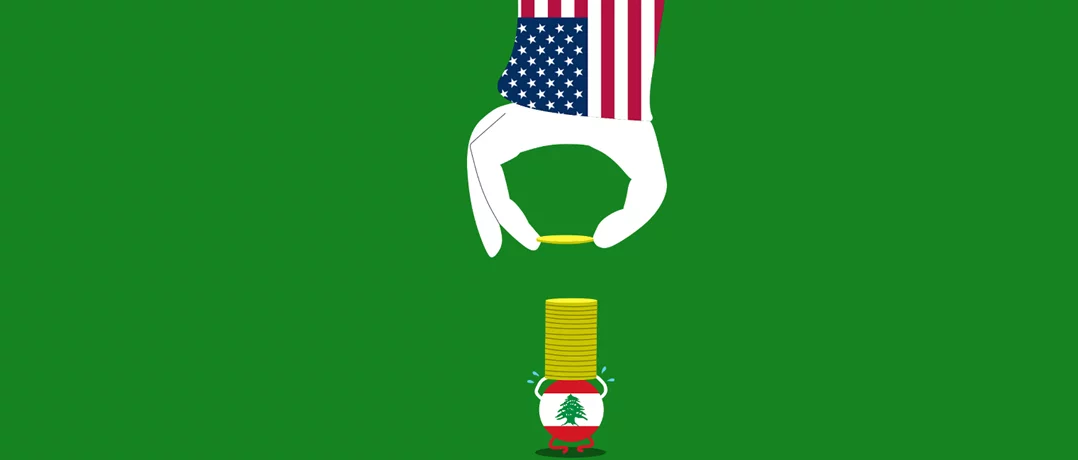

Lebanon risks losing competitiveness in the U.S. market as Washington considers tariff penalties linked to trade with Iran.

How US sanctions on Iran could put Lebanon’s exports at risk

How US sanctions on Iran could put Lebanon’s exports at risk

U.S. tariffs have returned to the forefront once again as a pressure tool in the trade war led by the United States, within protectionist policies aimed at safeguarding the competitiveness of the American economy. What is new this time is the use of tariffs as part of economic sanctions against Iran. In this context, U.S. President Donald Trump announced the imposition of a 25% tariff on the exports of any country to the U.S. market if it is proven to have any commercial dealings with Tehran. What does Lebanon have to do with this economic pressure tool?

Lebanon is among the countries exposed to the possible application of the 25% tariff if it continues to engage in direct or indirect trade with Iran. Currently, Lebanon pays a 10% tariff on Lebanese products entering the United States, the lowest rate, similar to that applied to some Arab countries, and unlike other states where tariffs range from 34% on China, for example, to 39% on Iraq and 20% on Jordan. How would the 25% rate be applied in practice if it were to include Lebanon, as suggested by an unofficial, formally undefined and non-detailed decision?

Tariff penalties are considered secondary trade penalties, which are not classified as traditional sanctions, and represent a newly introduced U.S. weapon in the arena of economic warfare. The timing of this measure coincides with escalating pressure on Iran amid widespread internal protests, allowing the U.S. president to project a tougher stance toward any country perceived as supporting Iran’s economy through trade. From this perspective, Lebanon could be affected if the decision is implemented.

So far, there is no official decision or detailed document from the White House explaining how these tariffs would be applied, nor a precise definition of what constitutes “trade dealings with Iran,” or whether specific goods would be included. The announcement was broad and encompasses many countries with significant trade ties to Iran (such as India, China, and others), which is why Lebanon was not named explicitly. Rather, the decision applies to all countries that engage in trade with Iran. What does this mean?

If there is direct commercial activity between Lebanon and Iran, for example, and Lebanon exports goods to the United States (national industries, merchandise, etc.), this would place it among the countries potentially subject to these tariffs. In that case, instead of paying the current 10%, Lebanon would pay 25%, an increase of 15% on Lebanese goods entering the U.S. market. The question then becomes: how significant would the impact of imposing a 25% tariff be on Lebanese exports to the United States?

Trade between Lebanon and Iran

Before examining the value of exports to the United States, it is necessary to address trade cooperation with Iran. The volume of trade between Lebanon and Iran is relatively small and could be halted, as Lebanese traders tend to avoid dealing with Iran due to U.S. sanctions. Nevertheless, according to industrialists, Lebanon would still be affected by the 25% tariff if it maintains trade relations with Iran.

Statistics from the Lebanese Customs Directorate show that Lebanon’s exports to Iran amounted to $600,000 in 2024, an extremely modest figure compared to Lebanon’s overall global trade. These exports increased during the first eight months of 2025 to $727,000.

Imports from Iran to Lebanon, however, are significantly higher. They reached approximately $50.18 million in 2024 and $36 million during the first eight months of 2025. According to informed sources, Iranian imports to Lebanon are concentrated mainly in iron. This is considered an unhealthy indicator for the Lebanese market and would harm Lebanon if the situation persists, as it undermines efforts to lift the ban on Lebanese exports to Gulf countries, particularly Saudi Arabia, which represents an important market for Lebanon. It also sends negative signals to investors and international partners and places Lebanon in a politically and economically confrontational position with its traditional partners.

These figures indicate that while trade relations between Lebanon and Iran are minimal, they do exist in official figures issued by Lebanese customs. This means they do not represent major economic entities in Lebanese trade. What, then, about Lebanese exports to the United States?

Volume of Lebanese exports to the United States

If the 25% tariff is applied to Lebanon, a scenario whose details may become clearer next week, Lebanese manufacturers exporting to the U.S. market would be affected. Prices of Lebanese products entering the United States would rise, making them unable to compete due to inflated costs.

In 2024, according to a World Bank report, the United States emerged as the fourth-largest market for Lebanese exports, accounting for 5.7% of total exports, with a value of $153 million in 2024 and $107 million during the first eight months of 2025, based on figures from the Lebanese Customs Directorate.

As for imports into Lebanon from the United States, which are unrelated to the 25% tariff, the United States ranked as the ninth-largest exporter to Lebanon, with a value of $570 million according to customs figures. China ranks first in exports to Lebanon with an 11.6% share, followed by Greece, Switzerland, and Turkey.

Competing countries with Lebanon

Ziad Bekdach, Vice President of the Association of Industrialists, told Nidaa Al Watan that “exports to the United States include food products, wine, and lambskin gloves… and the 25% tariff would negatively affect industrialists if Lebanon is among the countries subjected to this tariff for maintaining trade with Iran.” Bekdach explained that the Lebanese products exported to the U.S. are the same products exported by Saudi Arabia, Israel, Turkey, and Gulf countries to the American market.

Israel and the Gulf countries are considered direct competitors to Lebanon in food products exported to the U.S., as Saudi Arabia and Israel would not be subject to the 25% tariff on their products entering the U.S. market. This would mean their goods would be cheaper than Lebanese exports. As for Turkey, it would be subject to the 25% tariff, meaning its problem would mirror Lebanon’s, with Turkish industries exporting to the U.S. facing price increases similar to Lebanese industries.

It is worth noting that the range of Lebanese exports to the United States is limited and driven largely by demand from the Lebanese diaspora in the U.S., estimated at around one million people. According to Bekdach, these exports include mineral or chemical fertilizers and phosphates, jewelry and diamonds, olive oil, fruits, nuts, canned vegetables and jams, as well as coffee, ginger, turmeric, sugar-based confectionery including white chocolate, water, bread, and cakes.

In conclusion, any commercial engagement with Iran, should the 25% tariff come into force, would not merely be a technical decision or a loss stemming from the inability of Lebanese industries to compete in the U.S. market. Rather, it would represent a direct choice to push Lebanon, already politically sensitive, economically fragile, and striving to restore international confidence, toward greater isolation and a deepening economic divide.